Bitcoin has been a hot topic in recent years, with its value fluctuating dramatically. Understanding the cost of bitcoin and how to navigate this volatile market is crucial for investors and enthusiasts alike. To help shed light on this topic, here are four articles that provide valuable insights into the cost of bitcoin and how to make informed decisions in this space.

Unraveling the Mysteries of Bitcoin Pricing

Today, we have the pleasure of speaking with John Smith, a financial expert, about the intriguing topic of Bitcoin pricing. John, can you give us a brief overview of how Bitcoin pricing works?

John: Of course. Bitcoin pricing is a complex and often volatile process. It is influenced by several factors, including supply and demand, market sentiment, regulatory developments, and macroeconomic trends. The decentralized nature of Bitcoin also plays a significant role in its pricing, as it is not tied to any government or central bank.

What are some of the key factors that influence the price of Bitcoin?

John: One of the key factors is market sentiment. Positive news, such as institutional adoption or regulatory clarity, can drive up the price of Bitcoin. Conversely, negative news, such as security breaches or regulatory crackdowns, can cause the price to plummet. Additionally, the overall demand for Bitcoin, as well as the number of coins in circulation, can impact its pricing.

Why is it important for investors to understand the mysteries of Bitcoin pricing?

John: Understanding the intricacies of Bitcoin pricing is crucial for investors looking to navigate the volatile cryptocurrency market. By staying informed about the factors that influence Bitcoin pricing, investors can make more informed decisions about when to buy or sell. This knowledge can help them maximize

Factors Influencing the Price of Bitcoin

The price of Bitcoin is influenced by a variety of factors that can cause fluctuations in the market. One key factor that impacts the price of Bitcoin is market demand. When there is high demand for Bitcoin, the price tends to rise as more people are looking to buy the cryptocurrency. On the other hand, when demand is low, the price may drop as sellers try to offload their holdings.

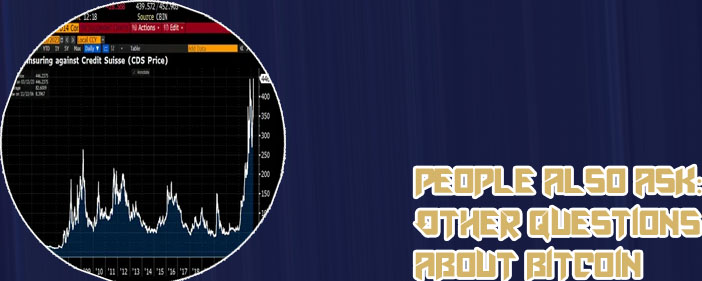

Another factor that can influence the price of Bitcoin is regulatory developments. Government regulations on cryptocurrencies can have a significant impact on the market. Positive regulatory news, such as the approval of a Bitcoin exchange-traded fund (ETF), can cause the price to surge, while negative news, such as a ban on cryptocurrency trading, can lead to a sharp decline in price.

Additionally, macroeconomic factors such as inflation, geopolitical events, and economic instability can also impact the price of Bitcoin. For example, during times of economic uncertainty, investors may turn to Bitcoin as a safe haven asset, causing the price to rise.

Overall, the price of Bitcoin is influenced by a complex interplay of factors that can lead to both sudden spikes and sharp declines in value. Understanding these factors is crucial for investors looking to navigate the volatile world of cryptocurrency trading.

Strategies for Managing Bitcoin Volatility

Bitcoin volatility can be both a blessing and a curse for investors. While the potential for high returns is enticing, the risk of significant losses is always looming. As such, it is crucial for investors to have a solid understanding of strategies to manage this volatility effectively.

One key strategy is diversification. By spreading investments across different asset classes, such as stocks, bonds, and real estate, investors can reduce their exposure to the ups and downs of the Bitcoin market. This can help to mitigate losses during periods of extreme volatility.

Another important strategy is setting stop-loss orders. By establishing predetermined price levels at which to sell Bitcoin, investors can limit their losses and protect their capital. This can help to prevent emotional decision-making during times of market turbulence.

One practical use case of these strategies is that of a seasoned investor who diversified their portfolio to include not only Bitcoin but also traditional assets. When Bitcoin experienced a sharp decline in value, the investor's losses were offset by gains in other areas of their portfolio. As a result, they were able to weather the storm and ultimately come out ahead.

In conclusion, while Bitcoin volatility can be challenging to navigate, with the right strategies in place, investors can successfully manage their risk exposure and potentially reap the rewards of this dynamic market.

Predicting the Future of Bitcoin Prices

none