In recent years, there has been a growing interest in the concept of Bitcoin proof of stake as an alternative to the traditional proof of work mechanism. This shift towards a more energy-efficient and scalable solution has sparked discussions and debates within the cryptocurrency community. To delve deeper into this topic, here are 3 articles that provide valuable insights and analysis on Bitcoin proof of stake:

The Evolution of Bitcoin: Transitioning from Proof of Work to Proof of Stake

Bitcoin, the world's first decentralized digital currency, has undergone significant evolution since its inception in 2009. Originally operating on a proof of work consensus algorithm, which requires miners to solve complex mathematical puzzles to validate transactions and secure the network, Bitcoin is now poised to transition to a proof of stake model.

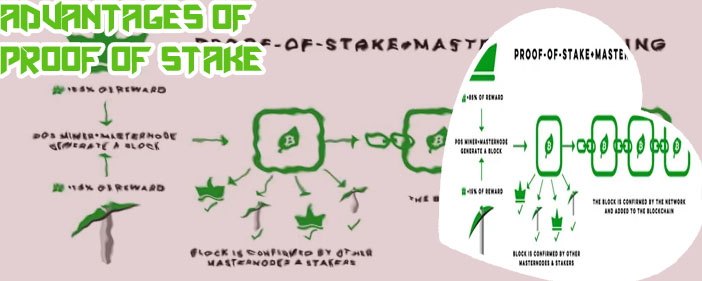

Proof of stake is a consensus mechanism that selects validators based on the number of coins they hold and are willing to "stake" as collateral. This shift from proof of work to proof of stake is driven by the desire to improve scalability, energy efficiency, and security on the Bitcoin network. By reducing the reliance on energy-intensive mining activities, proof of stake offers a more sustainable and environmentally friendly alternative.

Prominent figures in the cryptocurrency space, such as Ethereum co-founder Vitalik Buterin, have advocated for the adoption of proof of stake as a more efficient consensus mechanism. In addition, leading cryptocurrency exchanges and platforms have expressed support for this transition, recognizing the potential benefits it could bring to the Bitcoin network.

As Bitcoin continues to evolve and adapt to changing market dynamics, the transition to proof of stake represents a significant milestone in the cryptocurrency's journey towards mainstream adoption. With ongoing developments and innovations in the blockchain space, the future of Bitcoin and other digital assets remains promising and full of

Understanding the Security Implications of Bitcoin Proof of Stake

none

Examining the Economic Incentives of Bitcoin Proof of Stake Implementation

Bitcoin has long been the dominant player in the world of cryptocurrencies, but its energy-intensive proof of work consensus mechanism has drawn criticism for its environmental impact and scalability issues. As a potential solution, many have proposed transitioning Bitcoin to a proof of stake system, which would require users to hold a certain amount of coins in order to validate transactions and secure the network.

One of the key economic incentives of implementing a proof of stake system for Bitcoin is the potential for reduced energy consumption. Unlike proof of work, which requires miners to solve complex mathematical puzzles using powerful hardware, proof of stake simply requires users to hold coins in a wallet. This could lead to significant cost savings and a smaller carbon footprint for the Bitcoin network.

Additionally, proof of stake could help to democratize the process of validating transactions on the network. In a proof of work system, miners with access to cheap electricity and specialized hardware have a competitive advantage, leading to centralization of mining power. With proof of stake, on the other hand, anyone who holds coins can participate in the validation process, potentially leading to a more decentralized network.

Overall, examining the economic incentives of Bitcoin proof of stake implementation reveals promising benefits in terms of energy efficiency, decentralization, and cost savings. For anyone interested in the future of Bitcoin and sustainable